Surprise Bills, Benchmarks, And The Problem Of Indexation

This article originally appeared on Health Affairs.

Over the past year, the congressional debate over surprise billing has converged on two policy options to resolve out-of-network payments—1) a simple benchmark, in which a health plan pays out-of-network providers the median rate agreed with local in-network providers in the same specialty, or 2) a similar benchmark combined with optional arbitration if the provider or payer objects to that default amount. These reforms would dent staffing company and hospital revenues by only 0.75 percent to 1.00 percent over the next 10 years—while aggregate hospital and physician revenues rise by more than 60 percent, or $1.6 trillion—yet, the legislation has sparked a furious lobbying campaign to perpetuate the status quo. Meanwhile, the Sturm und Drang over arbitration has eclipsed discussion of other policy details, some of which could create pernicious long-term distortions in a market already mired in dysfunction.

One such detail is highlighted in the House Energy and Commerce Committee (E&C) proposal to index benchmark payments to 2019 commercial prices, using the Consumer Price Index (CPI-U). Such indexing creates a payment floor at 2019 pricing levels, plus future inflation. In contrast, the Senate version does not index the benchmark to a point in time, allowing local prices to fluctuate as markets change. The notion of indexation presumes that health insurers have leverage to drive prices down, necessitating a special reimbursement floor for the providers most likely to engage in surprise billing—anesthesiologist, radiologists, and emergency physicians. As discussed below, that presumption is false: Health care providers generally have far more market power than insurers. Moreover, E&C’s indexation proposal will exacerbate the yawning gap between the prices charged to privately insured patients and the prices paid by public plans, aggravate imbalances across geographies and specialties, reduce health insurer competition, and short-circuit innovation that could lower the cost of health care. Policy makers would be wise to implement a benchmark based on local commercial prices, as in the Senate bill, without the damaging rigidity of an ever-rising price floor that results from indexing to a fixed point in time.

Market Concentration, Bargaining, And Prices

Hospitals, physician groups, and health insurers have all consolidated in recent years. Roughly 75 percent of US metro areas have “highly concentrated” hospital markets, with specialist physician consolidation only a bit less pronounced. Provider mergers have inflated prices for hospitals, specialist services, and primary care. Similarly, when measured in isolation, insurer consolidation tends to increase premiums, even as it improves carriers’ bargaining power, allowing them to secure lower hospital pricing.

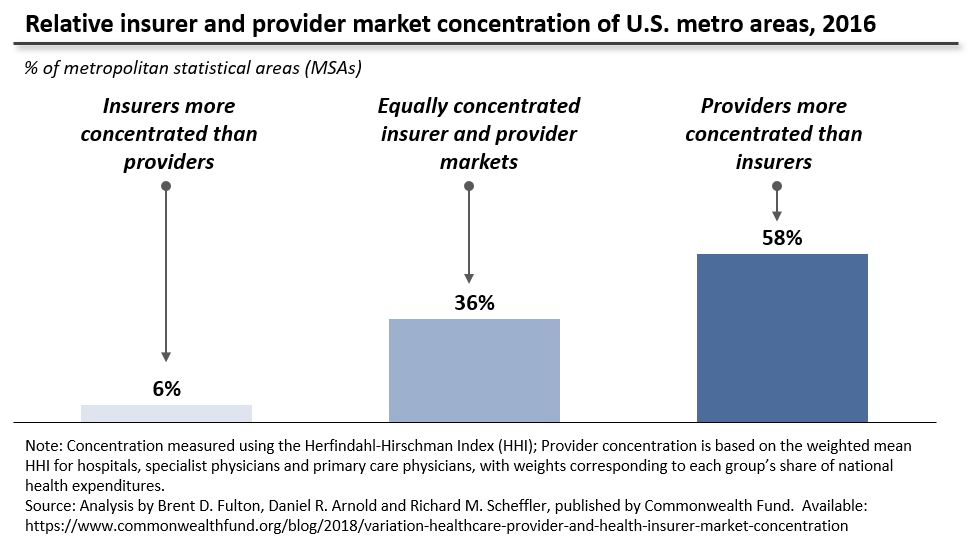

The theoretical case for indexing the payment benchmark turns on this last effect. The specialist staffing firms, which use the threat of out-of-network billing to secure unusually high contracted rates, argue that insurers have overwhelming market power, and so—in the absence of indexing—would push rates down precipitously if balance billing were disallowed. This logic is flawed in two ways. First, since insurers that administer a plan are typically paid a percentage of its overall cost, this argument ignores carriers’ “incentive to keep costs high and growing.” Moreover, as exhibit 1 illustrates, providers are more concentrated than insurers in almost 60 percent of US metro areas, while health plans hold an edge in only 6 percent of local markets. Furthermore, national- and state-level studies show a steady rise in concentration among specialist physicians, primary care providers, and hospitals alike. As Brent D. Fulton found, concentration of insurers actually fell slightly from 2010 to 2016, while rising for both specialist physicians and hospitals. The evidence, in short, suggests that provider organizations will retain significant bargaining leverage even after out-of-network billing reform, leaving little scope or incentive for insurers to push prices down sharply.

Exhibit 1: Relative insurer and provider market concentration of US metro areas, 2016

Mind The [Price] Gap[s]!

Because the E&C proposal would permanently index out-of-network payments to 2019 prices, using CPI-U, the provision would insert a statutory pricing wedge between private and public coverage and aggravate economic disparities across geographies and specialties. For example, an anesthesiologist handling knee surgery for a 64-year-old individual with employer coverage in New York state is paid, on average, 7.4 times the price she would earn for conducting the same procedure on a 66-year-old New Yorker on Medicare, and more than 2.5 times what she would earn for a privately insured knee patient in neighboring Pennsylvania.

Some pricing disparities are rooted in supply or demand—for example, higher reimbursement to recruit physicians to rural areas—but many gaps reflect existing market failures, and the surprise billing “option” is a “systemic failure” that has created powerful pricing leverage for a few specialties. Nationwide, for example, anesthesiologists and emergency physicians command private prices that average 344 percent and 306 percent of Medicare rates, respectively, while most doctors make do with 125 percent to130 percent. Since Medicare rates reflect “relative value” figures recommended by the American Medical Association, these divergent multiples reflect relative overpayment of key surprise billing specialties, in the judgment of the physician community itself. Because the E&C proposal uses a 2019 base year, it would lock in and then enlarge the consequences of this market failure.

First, the compounding effect of indexation will widen the existing gap between the prices paid by patients and plans in the employer-sponsored and individual markets, and the lower prices available to patients enrolled in Medicare and Medicaid. For example, if CPI-U continues to rise at the 1.5 percent to 2 percent pace observed over the past decade, and Medicare physician payments increase at the slightly lower rate prescribed by the Medicare Access and CHIP Reauthorization Act (MACRA), the E&C indexation proposal will obligate private employers and insurers to pay an ever-greater multiple of Medicare. Average commercial reimbursement for anesthesiologists, for example, would rise from 344 percent of Medicare today to roughly 400 percent by 2030. Stuart Altman and others have noted how the growing gap between provider prices paid by public and private plans strains the health system, heightening incentives for providers to “cherry pick” patients and pushing Medicare and Medicaid to match surging private prices with taxpayer dollars. Indexation would amplify this strain, creating a statutory requirement that the cost of care must rise more quickly in private plans than in public coverage, to the detriment of patients ineligible for public plans and the employers obligated to pay ever-higher premiums.

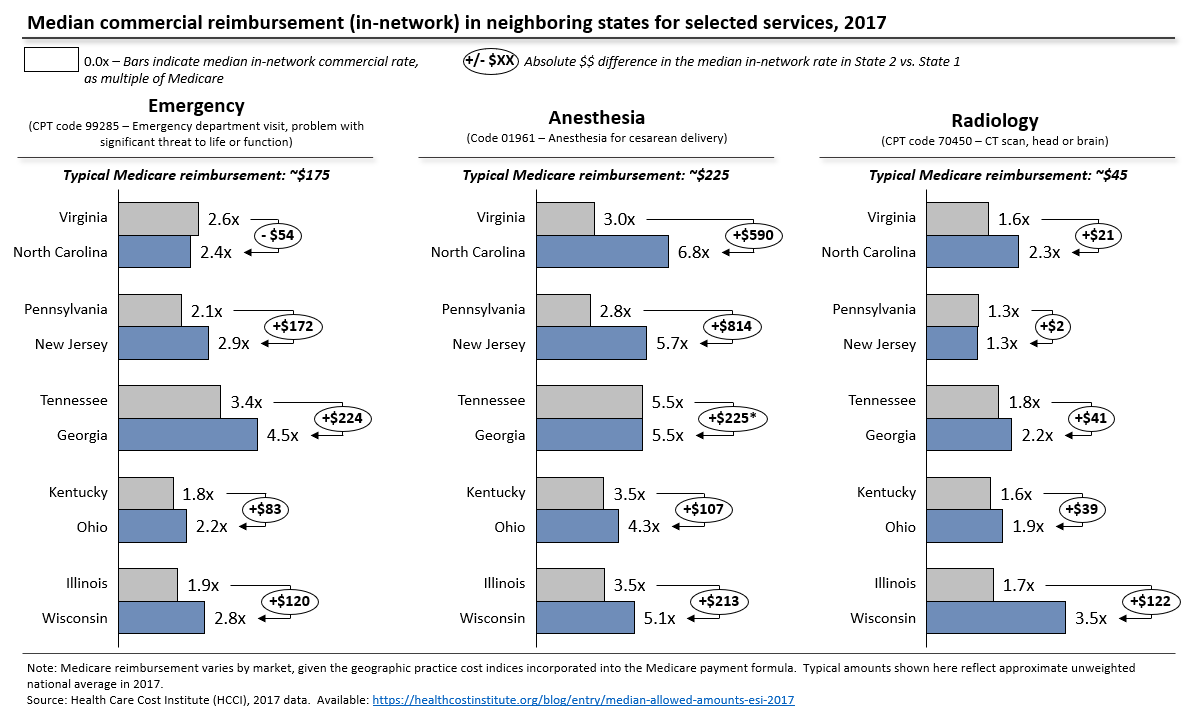

Indexation will also deepen pricing disparities across neighboring geographies (exhibit 2), which may distort access to care. If today’s prices are fixed and indexed, an anesthesiologist moving from Virginia to North Carolina could more than double his or her income from attending a cesarean delivery, and a radiologist could earn $122 more for reading a computed tomography (CT) scan in Wisconsin as compared with Illinois, equivalent to completing two extra CT scans for Medicare patients. These disparities obviously exist today but are harder to exploit, since most reimbursement currently depends on a network agreement, and movement of physicians from one market to another tends to lower prices, as more clinicians compete to staff the same emergency department or read the same scans. Arbitrage will become much easier if federal law mandates timely reimbursement at benchmark rates, irrespective of network status, a feature of all major legislative proposals. The E&C indexation proposal would also block the normal market adjustment, keeping prices at 2019 levels, plus inflation, regardless of changes in local physician supply. As the $590 Virginia-North Carolina anesthesia price differential rises to around $700 through statutory indexation, clinicians and private equity-backed staffing companies are likely to notice, with worrying implications for both patient access and national health expenditures.

Exhibit 2: Median commercial reimbursement (in-network) in neighboring states for selected services, 2017

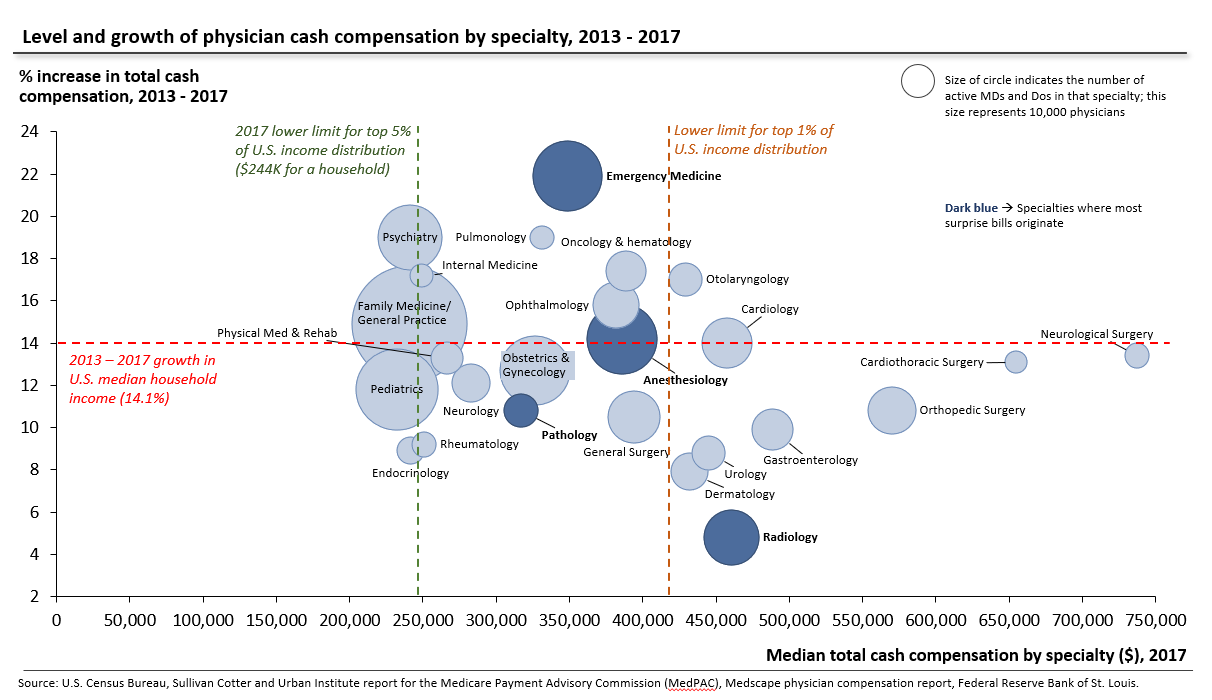

Similarly, indexation will enlarge the existing reimbursement skew across specialties. Compensation varies widely across specialties (exhibit 3). Some of these differences—notably the rapid rise in emergency physician compensation—can be traced to the cycle of private equity-fueled practice buyouts and price hikes, which put surprise billing on the national agenda. Indexation will prevent supply/demand adjustments as clinicians enter and leave certain specialties, locking in current levels of emergency physician compensation and forcing accelerated reimbursement for radiologists, just as private and public payers have clamped down on unnecessary diagnostic imaging, flattening radiologist salaries in a saturated market.

Exhibit 3: Level and growth of physician cash compensation by specialty, 2013–17

Limiting Competition, Slowing Innovation

Finally, the mechanics of indexation will create barriers to the entry of new health plans, diminishing insurer competition, and foreclose pathways to improved productivity, particularly in radiology, pathology, and anesthesiology. To understand these effects, we must delve further into the details of these policy proposals.

The primary Senate and House bills both use a plan-specific median for out-of-network payments (that is, an Aetna preferred provider organization employer plan will have a different benchmark than an individual Centene health maintenance organization [HMO] plan), which is also common in state laws that employ similar benchmarks. This plan-specific element is necessary to avoid a jump in costs for individual and small-business plans, where HMOs and narrow networks help achieve lower pricing, and to preserve the incentive for insurers to bargain for competitive prices. A marketwide benchmark—in which all health plans pay the same out-of-network price regardless of plan design or contracting effort—also eliminates the competitive advantage of price negotiations and so creates a free-rider problem that would accelerate price inflation.

Public data on price variation among insurers is limited, but several studies (see Ge Bai and Gerard Anderson, 2018; or Stuart V. Craig, Keith Marzilli Ericson, and Amanda Starc, 2018) have found that carriers that pay for relatively little care in a local market tend to pay higher prices. Consistent with this evidence, the staffing companies that employ surprise billing as a negotiating tactic have suggested that their in-network emergency reimbursement from local Blue Cross Blue Shield (BCBS) plans tends to run at about 200 percent of Medicare rates, while national commercial carriers (for example, Cigna or UnitedHealthcare) often pay more than 400 percent of Medicare. Some of this may be attributable to state laws that have long limited balance billing for HMO enrollees, but cash flow leverage could also be a factor. BCBS plans often cover 20 percent to 40 percent of local patients and may be able to secure some price concessions by offering faster electronic payments to in-network providers, even without the ability to steer patients away from out-of-network providers.

Because indexation must start with a point in time, these price variations create significant complexity. Insurers enter and leave markets, and regularly launch and sunset particular plan products. The E&C legislation does not specify how regulators should establish benchmarks for a plan that enters a market in, say, 2023, and hence does not have 2019 claims to calculate a benchmark. The most likely outcome is for regulators to establish some sort of national “commercial fee schedule” based on data from all-payer commercial claims databases, in which a new entrant would be obligated to pay the marketwide average in-network rate in 2019, adjusted for subsequent inflation. In practice, this will obligate all new entrants to pay prices well above those of the largest incumbent insurer—a recipe that puts new plans at a permanent competitive disadvantage and is therefore likely to weaken insurer competition.

Finally, indexation puts a floor under today’s inflated prices, just as technological and organizational shifts open the door to potentially cost-saving innovation, particularly in radiology, pathology, and anesthesiology. A host of firms and institutions are using artificial intelligence (AI) to record and interpret diagnostic imaging studies, and some of these tools perform better than human radiologists. AI-assisted pathology has also been shown to improve the accuracy and speed of screening tissue removed during a biopsy or surgery, a classic scenario for surprise out-of-network pathology bills. Researchers spot similar opportunities for machine learning to automate elements of the anesthesia workflow. Over the coming decade, these advances could expand productivity, allowing an AI-assisted radiologist to accurately evaluate, for example, five chest x-rays in the time previously required to examine three. Similarly, computer-assisted anesthesia could allow a certified nurse anesthetist (average salary: $160,000) to safely handle more procedures, in place of an MD-trained anesthesiologist (average salary: $392,000). This could take the form of a single physician overseeing multiple operating theatres staffed by AI-supported nurse anesthetists. However, the E&C proposal indexes payment to current prices for individual units of service (for example, price per scan or 15 minutes of anesthesia) and so eliminates the mechanism for this innovation to lower patient or employer bills.

If You Find Yourself In A Hole, Stop Digging

In sum, the House E&C indexation concept is rooted in a false premise about insurer and provider bargaining power and will undermine the overall competitiveness of non-governmental coverage, warp clinical care availability across geographies and specialties, entrench incumbent insurers, and inhibit much-needed innovation. As Mark Miller and colleagues have argued, policy makers should choose either a benchmark tied to Medicare—which would narrow price gaps instead of compounding them—or one based on median commercial rates without CPI indexation. The Senate bill, which adopts this latter approach, would solve the core market failure and leave room for market participants to gradually correct the accumulated imbalances over time. Surprise billing has contributed to a price spiral for privately insured patients, which threatens the viability of private coverage. Policy makers should be working to bring prices down, not mandating further increases for a few highly compensated services, through rigid, statutory indexation.