Digital Health and the Two-Canoe Problem

This article originally appeared as a guest post on The Healthcare Blog (THCB), founded and edited by Matthew Holt.

As healthcare gradually tilts from volume to value, physicians and hospitals fear the instability of straddling “two canoes.” Value-based contracts demand very different business practices and clinical habits from those which maximize fee-for-service revenue, but with most income still anchored on volume, providers often cannot afford a wholesale pivot towards cost-conscious care. That financial pressure shapes investment and procurement budgets, creating a downstream version of the two-canoe problem for digital health products geared toward outcomes or efficiency. Value-based care is still the much smaller canoe, so buyers de-prioritize these tools, or expect slim returns on such investment. That, in turn, creates an odd disconnect. Frustrated clinicians struggle to implement new care models while wrestling with outdated technology and processes built to capture codes and boost fee-for-service revenue. Meanwhile, products focused on cost-effectiveness and quality face unexpectedly weak demand and protracted sales cycles. That can short-circuit further investment and ultimately slow the transition to value.

To skirt these shoals, most successful innovators have clustered around three primary strategies. Each aims to establish a foothold in a predominantly fee-for-service ecosystem, while building technology and services suited for value-based care, as the latter expands. A better understanding of these models – and how they address different payment incentives – could help clinicians shape implementation priorities within their organizations, and guide new ventures trying to craft a viable commercial strategy.

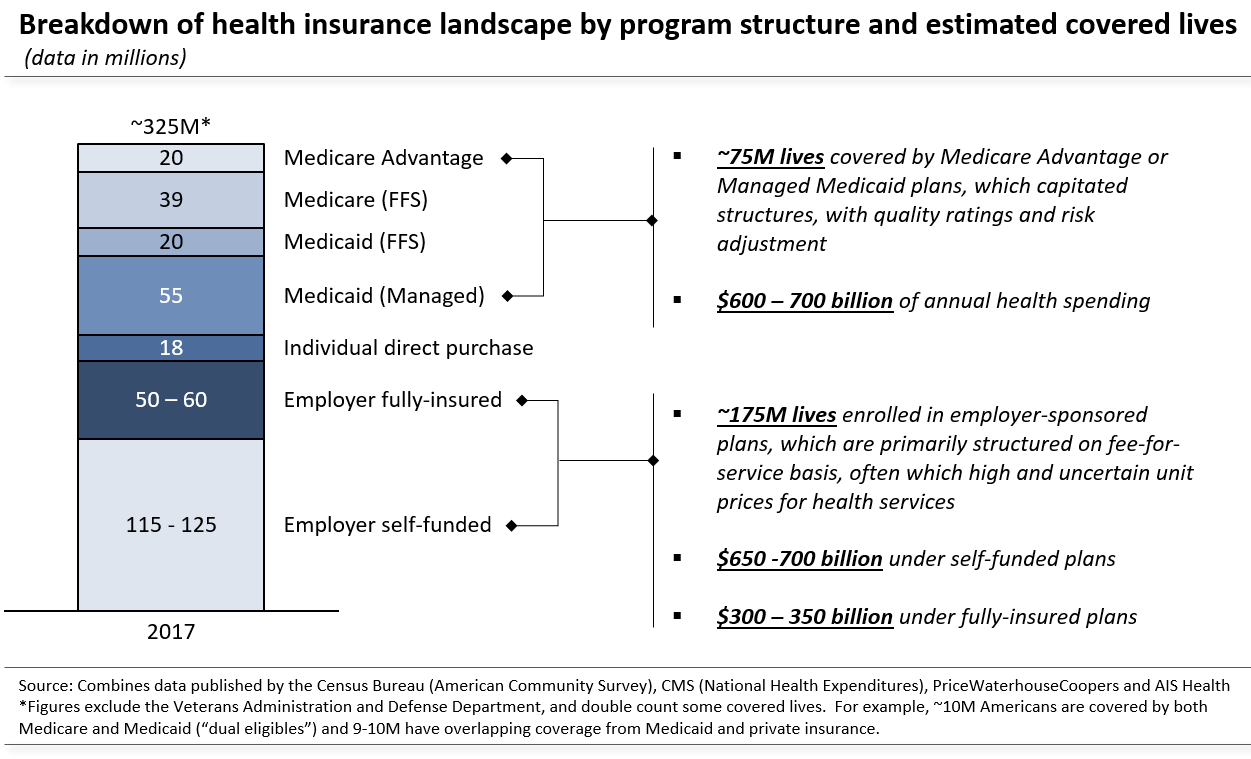

The first is to focus on Medicare Advantage (MA) and Managed Medicaid (MM), where risk-adjusted capitation and quality ratings approximate many features of value-based reimbursement, even when individual providers are still paid on a fee-for-service basis. This limits the market (see figure below), but allows developers and designers to emphasize workflows and insights which can facilitate other pay-for-performance scenarios, as these proliferate. Such an approach is particularly common among vendors like Evolent Health (EVH) and Lumeris, who offer technology and services geared toward MA and MM patients, which can extend to handle Medicare’s shared savings program and other accountable care arrangements. Natural language processing engines and case management software often take a similar tack, targeting near-term revenue gains from risk adjustment or HEDIS scores, while securing a toehold for a longer-term push into medical management. Finally, clinical data services also tend to focus on risk adjustment as an immediate business case, while building data-sharing infrastructure which could improve care coordination and curb costly duplication, once payment contracts broaden the incentives to do so.

The second strategy targets a different patient segment entirely – those with employer-sponsored, fee-for-service plans. This coverage is plagued by high and unpredictable prices for hospital and physician services, which creates an arbitrage opportunity; technology-driven services can deliver financial returns by nudging patients toward better value or even replacing traditional providers altogether. Grand Rounds, for example, acts as a concierge, shepherding patients toward centers of excellence, which pursue fewer unnecessary procedures and have better outcomes. Others, such as Livongo and Hinge Health, try to supplant traditional providers with remote coaches and self-management programs, delivered through mobile applications and other connected devices. These services may improve patient outcomes, but the business case relies heavily on steering patients away from expensive interventions or facilities. Today, firms pursuing this strategy generally sell to self-insured employers, but have used that niche to test models of lower-cost care and to build patient navigation and coordination tools. Both should eventually be valuable for any provider network (or insurer) which is financially accountable for care quality and efficiency.

Finally, some digital health firms operate across all patient segments but target specific use cases which promise financial returns under both fee-for-service and value-based contracts. Typically, they emphasize the fee-for-service case today and plan to pivot as outcomes-oriented care models expand. Referral networks may be the clearest example. Fee-for-service revenue from referral traffic creates a business case for diagnostics firms and hospitals to fund health information exchange links with ordering providers. As a result, hospitals, clinical labs and radiology groups pay electronic health record vendors (e.g. Athena Health or Practice Fusion) and intermediary hubs like ReferralMD to connect referring physicians to their service centers, mirroring pharmacies’ funding of electronic prescribing infrastructure. Similarly, CoverMyMeds and Clarity Health (both since acquired) relied on the financial case for pharmaceutical manufacturers and specialists to streamline prior authorization hurdles for clinicians considering a specialty drug or referral. Over time, all of these narrowly-targeted networks chip away at healthcare’s interoperability deficit and establish a foundation for the longitudinal care coordination required under value-based care.

The two-canoe challenge for digital health highlights a system-wide dilemma. Physicians and hospitals cannot deliver consistently efficient, high-quality care without the necessary tools, but there is little incentive to invest in that toolkit until payment contracts ensure a financial return. This disconnect can retard adoption of new technology, and hence slow overall progress toward value-based care. These three strategies, however, offer pathways for innovation which is financially viable in today’s hybrid reimbursement landscape and helps assemble the infrastructure for cost-effective, outcomes-driven healthcare.