COVID-19 and Healthcare's Productivity Shock

This article originally appeared in NEJM Catalyst, co-authored with Alan Kaplan, MD.

COVID-19 and Healthcare’s Productivity Shock

The Covid-19 pandemic has highlighted the urgent need for health care providers to abandon volume-based payments in favor of models that give them financial stability in volatile times.

Summary

Hospitals and medical practices have seen rapid growth in headcount and labor costs, primarily in patient-facing roles. That growth was predicated on predictable revenue growth over time, an assumption now in question given the Covid-19 crisis and the resulting dip in procedure and visit volumes. Through a focused effort to re-balance revenues and embrace lighter, more efficient care delivery models, providers can weather the crisis and build healthier enterprises for the long term.

Introduction

In the U.S., Covid-19 is colliding with the largest, most lucrative healthcare industry in the world. And yet, as patients shy away from hospitals and clinics, the crisis is challenging longstanding pillars of providers’ revenue models, many of which focus on in-person visit volume, high-priced procedures, and profitable markups on drugs that physicians buy and bill to insurers and patients. While the shock may prove short-lived, it creates an opportunity for creative, forward-thinking organizations to reconsider purely transactional revenue streams and labor-intensive operating models. Such changes could leave us with a more sustainable healthcare system, grounded in more streamlined and accessible care delivery enterprises.

Labor-intensive delivery model

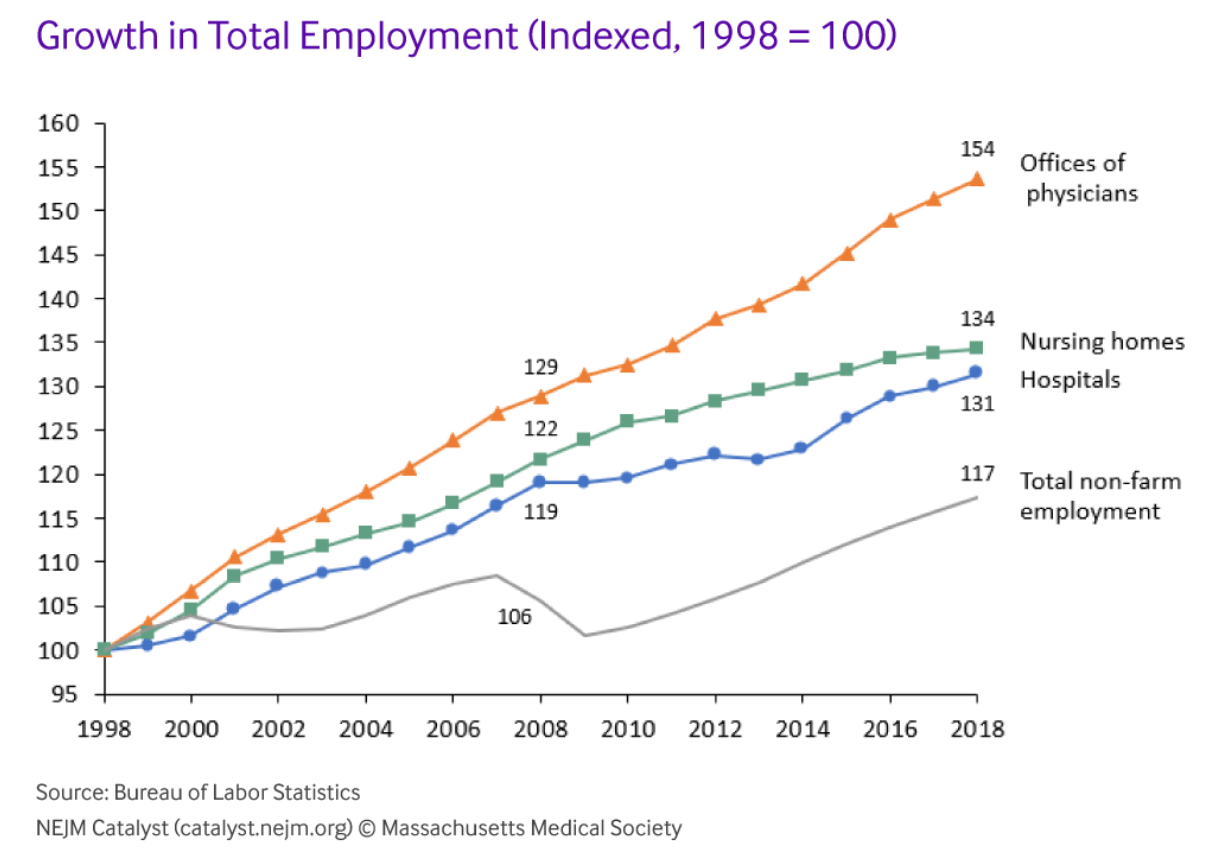

Over the last 20 years, as U.S. health spending swelled from 13% to 18% of gross domestic product, employment in healthcare also surged. Between 1998 and 2018, the number of staff working in physicians’ offices rose three times as fast as economy-wide employment. In hospitals, headcount is up by almost a third since the late 1990s. Healthcare services are inherently labor-intensive, but they have become much more so in recent years. America’s medical practices now employ more than eight full-time employees per 1,000 U.S. residents, up from just over six in 1998. Hospital staffing is approaching 16 employees per 1,000 people, up from 14 in the late 1990s, despite a significant drop in admissions per capita and the average length of stay.1

The sheer magnitude of financial resources flowing into healthcare contributes to this marked hiring growth. U.S. hospital revenues, for example, have risen by an average of $44 billion in each of the last ten years. In each of those years, hospitals hired almost 50,000 additional employees (Figure 1). Physicians’ offices have hired almost as aggressively, adding more than 40,000 staff per year.

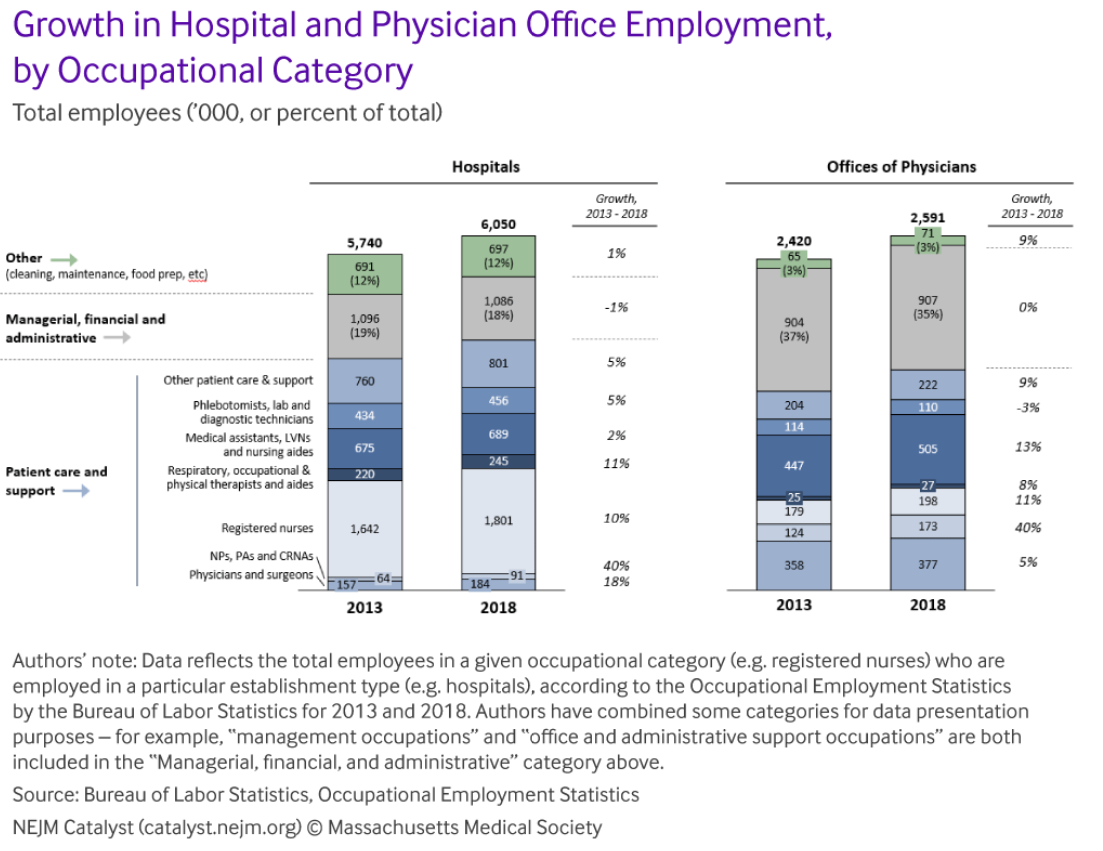

Contrary to common perception, the patient care and support roles account for the bulk of that hiring – from physicians and nurses to surgical technicians, health aides and social workers. Combined, hospitals and practices added almost half a million employees in patient-facing roles from 2013 through 2018, while the number of managerial, financial and administrative support staff actually declined (Figure 2). Hospitals, for example, cut office and administrative headcount by almost 30,000 over the last five years, while adding 27,000 physicians and surgeons, 24,000 nurse practitioners and physician assistants, and more than 150,000 registered nurses (RNs). In physicians’ offices, hiring emphasized advanced practice clinicians (NPs, PAs and CRNAs) and medical assistants.

As hiring surged, wages for health workers also ticked up. In aggregate, through expanded headcount and higher pay rates, aggregate wage bills for hospitals and physicians’ offices increased by roughly $100 billion…

Article continues on NEJM Catalyst, without a paywall, and includes additional graphics.